Introduction: Patients with sickle cell disease (SCD) have reduced quality-adjusted life expectancy due to substantial mortality risks and decreased quality-of-life for every year lived with the disease. Allotransplantation was the first treatment with curative potential, but it carries concomitant risks of transplant-related mortality and graft-versus-host disease (GVHD). Once approved, gene therapy would be the second treatment with the possibility of lifelong cure but unlike allotransplantation, it may do so without the concomitant risks. Prior research has shown that even if gene therapy is conventionally cost-ineffective versus the standard-of-care (SOC), it can be a justifiable treatment option for a historically marginalized patient population in the United States, as demonstrated by equity-weighted cost-effectiveness. For allotransplantation and gene therapy, neither conventional nor distributional (i.e., equity-weighted) cost-effectiveness is known. Accordingly, we conducted the first conventional and distributional cost-effectiveness analyses of allotransplantation therapy for pediatric patients with SCD in the United States.

Methods: We built a Markov model of pediatric patients with sickle cell disease to examine the cost-effectiveness of allotransplantation vs gene therapy vs SOC and determine equity weight thresholds. Sex-, age-, and disease-severity-specific annual costs and transition probabilities across disease severities for SOC were informed by 11 years of data from US commercially insured patients with SCD (2007-2017; Optum). Disease severity was defined based on annual number of hospitalizations for vaso-occlusive crises, as defined in clinical trials. SOC included hydroxyurea, opioid therapy, antibiotics, vaccinations, and blood transfusions. Allotransplantation- and GVHD-specific transition probabilities and costs were informed by prior literature and health resource utilization data, originally reported from the Center for International Blood and Marrow Transplant Research and the Pediatric Health Information System. Quality-adjusted life-years (QALYs) were informed by published lifetime simulations of patients living with SCD and matched controls, derived initially from a polynomial fit linking Euroqual-5 Dimensions to the visual analog scale for pain in patients with SCD in several studies. Age-, sex- and disease-specific background mortality probabilities were employed. Conventional cost-effectiveness was quantified using an incremental cost-effectiveness ratio (ICER), at a willingness-to-pay threshold of $100,000/QALY. Given expert clinical experience with optimizing allotransplantation outcomes in SCD, we employed a maximum patient starting age of 12 and assumed that gene therapy cost $2.45 million and was 100% effective. To account for health inequities in SCD, we then conducted a distributional cost-effectiveness analysis (DCEA), which applies an inequality aversion parameter (i.e., how much weight one puts on reducing disparities), to the distribution of outcomes across relevant sub-groups for allotransplantation to be favored over SOC and justify funding per DCEA standards. These were compared to prior estimates for commonly used equity weights in the United States (range 0.5-3.0).

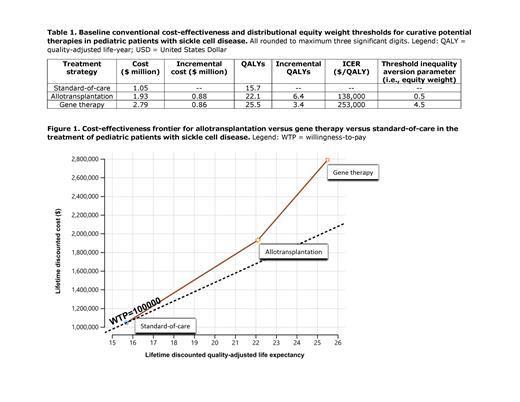

Results: In the base-case, allotransplantation, gene therapy, and SOC accrued 22.1, 25.5, 15.7 discounted lifetime QALYs at costs of $1.9, $2.8, $1.0 million, respectively, with all therapies on the cost-effectiveness frontier (Table 1). The ICERs and equity weight thresholds were $138,000/QALY and 0.5, and $253,000/QALY and 4.5, for allotransplantation (vs SOC) and gene therapy (vs allotransplantation), respectively.

Conclusion: Similar to findings for gene therapy versus SOC in the first published DCEA in sickle cell disease, allotransplantation also appears to be an equitable therapeutic option for pediatric patients with sickle cell disease, regardless of conventional cost-ineffectiveness and as compared to SOC. The consideration of patient-population-specific equity offers an important opportunity to derive transparent benchmarks for intertwined equity- and value-informed decision making. Quantitative consideration of equity in the context of conventional cost-ineffectiveness can be an important tipping point in justification of funding.

Disclosures

Krumholz:UnitedHealth: Consultancy; Eyedentifeye: Consultancy; Element Science: Consultancy; F-Prime: Consultancy; Refactor Health: Current equity holder in private company; HugoHealth: Current equity holder in private company; Johnson & Johnson: Consultancy; Pfizer: Consultancy; Google: Consultancy.

This feature is available to Subscribers Only

Sign In or Create an Account Close Modal